MUNAKU KAAMA KISUBI SACCO LTD

ANEW WAY OF COMMUNITY BANKING WHERE COMMUNITY MEMBERS NEEDS COME FIRST

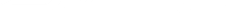

MKKSACCO CURRENT PRODUCTS AND SERVICE

SHARES ACCOUNT

Main Features Shares Capital- Nominal value of shares issued to members at their par value is sh10,000/=. Minimum Shares – required per member is 01 Maximum Shares- allowed up to 35% of total paid up shares Benefits Dividends – Are profits awarded on shares as and when determined by AGM Security – Acts as part of the security to the Loan

Fixed Deposit Accounts FIXED DEPOSIT ACCOUNT Main Features • Fixed Deposit Certificate – provides a savings plan for periods ranging from 6 -12 and above • Interest rates – upto 12% p.a • Opening Balance– Minimum opening balance is 100,000/=

Voluntary Savings

Cash Withdrawals are made at the counter and by use MKK SACCO Withdrawal slips. Flexible – member can vary the amount of savings deposits into his/her account but with a minimum of shs.2,000/= per saving. Accessible – member can withdraw money from his/her account using the withdrawal slips at the counter. Interest Rate –6 % p.a on monthly minimum interest bearing balance shs.50,000/= .Charges – Withdrawal fee 500/= 6000/= welfare per year, annual subscription fee 12000/= peryear. Benefits Account earns interest on Credit balance up to 3 % per annum , Unrestricted Cash withdrawals up to 1,000,000/= per day at the counter. And 2000,000 M with special order.

Saving Checklist at MKKSACCO.

No matter where you are in life, it’s never too late to make saving a priority. The first step on your savings journey should be to open a savings account and begin setting aside a portion of your pay as an emergency fund. While your savings goal will vary depending on your earnings and expenses, having roughly six months of living expenses saved up is ideal. Start with a smaller goal of saving a given sum of money regularly and keep building on it. Saving: The earlier you start saving, the more time your money has to grow.

Use the checklist below to make sure you’re on the right track Start saving. If you haven’t begun to build your savings, your primary goal should be to initiate a savings plan like investment or Retirement . Create a budget. Start by creating a budget for you to see where opportunities for additional savings may lie. If you make managing your money a priority now, saving for the future will be simple. Manage your debt. Try as much as you can to pay off what you owe and don’t take on any new debt. Once you’re out of the red, consider putting the money you were using to pay off your debt toward your savings goals. Build an emergency fund. Set aside some cash for emergencies so you aren’t tempted to.

LOANS PRODUCTS.

Development Loans

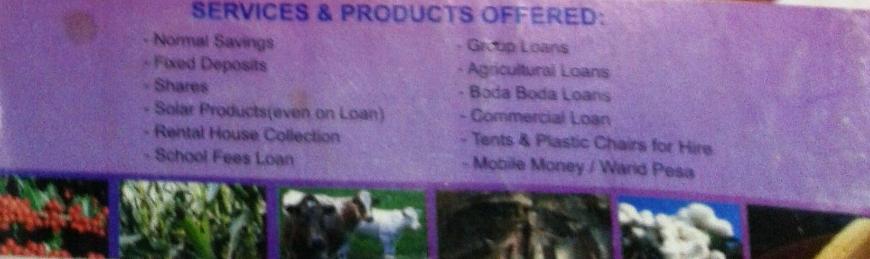

Asset Financing Loans(Acquisition of Assets) Business Loan (Trade & Commerce) AgricultureLoans(Farming) School fees loan Group loans. Loan Size Loan size is between Ush. 100,000 to Ush. 20,000,000. Requirement One must have been a member for at least 1 month A member must provide two guarantors who are MKK SACCO members. Recommendation from local authority and employer. A member must have 25% of shares and savings for the loan amount applied A member cannot withdraw below a minimum of 10,000/= from his/her savings account for all Loans reach for credit when unexpected costs arise Loan Granting Procedures Application All loan applications will be written on standardized forms supplied by MKK SACCO. The loan application should indicate: Name , Membership Number, Loan amount applied for , Purpose . Personal Particulars e.g. Home address; Date of membership in MKK SACCO. Member’s financial status at MKK SACCO Signature of member and a minimum of 2 guarantors Fully filled application Form with a passport photo attached to it Appraisal The application shall initially be assessed MKK SACCO loan committee. Thereafter, they will be submitted to MKK SACCO Head Office – Kisubi for final approval or disapproval. Disbursement Management encourages members that all approved loans be obtained through the member’s SACCO account Members therefore are requested to indicate on top of the loan application form, the following details: Basic Considerations when appraising loans Members’ savings and share capital Capacity to pay back Business plan in case of Business loans Building plans and stages of construction in case of housing loan Integrity of the prospective loan applicant Membership, Qualification for a loan requires one to have saved with MKK SACCO for six (6) months from the date of joining the SACCO and in addition, to have purchased at least ten (10) share Bank/SACCO Statement, Bank/SACCO statement showing the last two months business transactions. Must have a minimum of 2 guarantors Must present a passport photo and National ID.

Education and Sensitization Through mobilization and sensitization MKK SACCO has been able to grow and become the biggest SACCO in the community.

MKK SACCO strongly believes in educating its members all the time, and since learning is a gradual and continuous process , MKK SACCO always sends teams at least twice a year to meet its members within and outside the community.

And it’s a duty of all staffs and manager to guide and give knowledge to members whenever they seek it.

During mobilization and sensitization exercises members are educated in areas related to financial literacy, importance of saving, entrepreneurship skills development and many other areas

MKK women's group: This Women group is under Munaku Kaama SACCO, majority of these women are in the SACCO and some make their products using the money they borrow from the SACCO whereby it is marketed by their marketing manager and trainer, Nakimwero Catherine. Some of the products, the SACCO buys for material for the women and the women make the products and they are paid labour. This group was started inorder to improve the welfare and the living standards of the women inorder for them to pay school fees for their children, food, and medication, this has helped alot because most of the women in the group are in position to do that. It has got a small committee whereby Nakimwero Catherine the chairperson, Namugga Ritah is the secretary and Aunti Nalongo is the treasurer.